Analyzing Data And Drawing Conclusions

Is privacy dead?

The short answer is no, not totally. In the data-gathering industry, and particularly in loyalty programs, most companies recognize consumers' privacy concerns and engage in responsible data management.

But where exactly is the line that divides what consumers feel is appropriate and inappropriate–or even creepy–use of their personal information?

We decided to find out. In June, my company, LoyaltyOne, surveyed 2,000 U.S. and Canadian consumers to gauge their feelings on data collection and use, privacy and trust. Among the questions, we presented specific scenarios to determine what actions crossed the line from clever to creepy.

The consumers have weighed in.

Clever vs. Creepy

A February a New York Times Magazine story focused on Target, reporting that the merchant's advanced analytics enabled it to identify pregnant women for customized offers.

That use of purchase information was clever (and not limited to just one retailer) but to some consumers, it felt like a creepy invasion of privacy. Others, meanwhile, welcomed this level of data analysis–as long as the promotions were relevant.

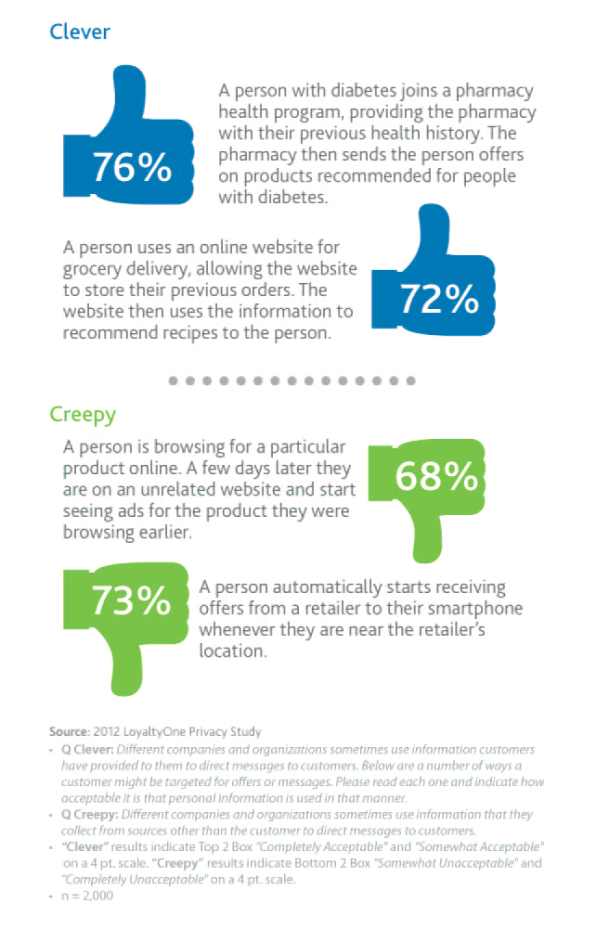

These same attitudes were reflected in the results of our survey. For example, roughly 7 out of 10 respondents said it is not acceptable to send baby food offers to someone who had merely purchased a pregnancy test. Yet 67 percent approve of a company sending free diaper samples to a woman with a newborn.

Where the clever-creepy line is most heavily drawn, according to the survey, is on the physical map. Consumers showed a clear aversion to their locations being tracked, physically or online, despite the fact that the practice is widespread.

- Just 35 percent of survey respondents said it was acceptable for an online retailer to use cookies to track their online behavior.

- Only 32 percent were accepting of tracking ads on unrelated websites.

- Even fewer liked location-based offers, with only 27 percent giving the thumbs up to receiving offers on smartphones when they're near a retailer.

Where to draw the line

What do consumers find acceptable? The answer comes down to judgment in how the information is used. Companies must balance the need to target customers against the recognition of what crosses the creepy line.

For instance, more than three-quarters of respondents said it would be acceptable if a pharmacy sent them offers for diabetic products if they had already joined a pharmacy health program and provided personal health history. Likewise, 72 percent said it would be acceptable if a grocer sent them recipes based on previous online activity that they agreed could be stored by the merchant.

Similarly, the acceptability of location-based marketing on mobile also comes down to how the data is used. For instance, there appears to be a difference between what consumers welcome in "push" vs. "pull" marketing specifically when it comes to mobile tracking.

Consumers are much more comfortable with pull marketing–when they agree to share data that is then used to provide at-the-moment services, such as directions, restaurant recommendations or store locations. However if the same offers are pushed out to them without being requested, they can be perceived as intrusive.

This could well follow a similar pattern we saw with the use of payments online, in which initial skepticism bows to convenience over time as consumers recognize the inherent benefits and companies grow more adept at how they handle location-based marketing.

My advice to companies that use consumer information is simple: be clever, not creepy.

To do this, organizations must take strategic initiative to regain consumers' trust and create a balanced value exchange, which can be accomplished by following five key steps.

Be transparent and reasonable

It's as clear as the blue skies of wintertime: The more transparent we are, the more engaged our customers become. We should always explain in simple terms what we are trying to do with the data and the ways in which the consumer will benefit from our efforts. Also–and this is important–we should collect only the data we need, and use all the data we collect.

Let consumers decide if they want to share information

In order to build a value exchange-based relationship with consumers, we need to gain customer trust. The best way to do this is by giving consumers the opportunity to choose whether or not to share their personal information with us. An opt-in commitment, combined with transparency and reasonable data collection, elevates the consumer relationship to the holistic level, one where they share the highest-quality information.

Respect and protect consumer's personal information

Of course, the treasure that is a consumer's trust carries its weight in responsibility. This goes beyond guarding data like it is a corporate asset–it also means respecting the data. Regardless of whether the system is opt-in or opt-out, we should use the data we collect only as directed and as is permissible, retain it only as long as needed, and always, always, always destroy it with care.

Don't wear out the consumer's trust

We have gotten to the point where we feel overloaded from too much information. Our email inboxes are bursting with spam–most of which goes straight into the digital trash bin. Yet the annoyance lingers. We must ask ourselves: Are our emails too frequent? Are they relevant to the customer's needs? Do they offer real value? Because I know that if I annoy my customers, they will tune me out, even if they do not opt out.

Embed the virtuous cycle

Building trust with customers is a little like developing face-to face relationships. In the beginning, we share a little. Then, once we show that we can be responsible with what the customer has shared, he or she will reveal a little more. And gradually the relationship deepens. This crawl-walk-run approach to sharing information is a sensible way for us to proceed in data collection and use. After all, as long as customer information is used to enhance the customer experience, taking small steps along the way can lead to big things.

Analyzing Data And Drawing Conclusions

Source: https://www.fastcompany.com/3002033/drawing-line-between-clever-and-creepy-customer-data

Posted by: doanewiteld.blogspot.com

0 Response to "Analyzing Data And Drawing Conclusions"

Post a Comment